Ecowatch

Big Banks Have Given Nearly $7 Trillion to Fossil Fuel Companies Since Paris Agreement, Report Says

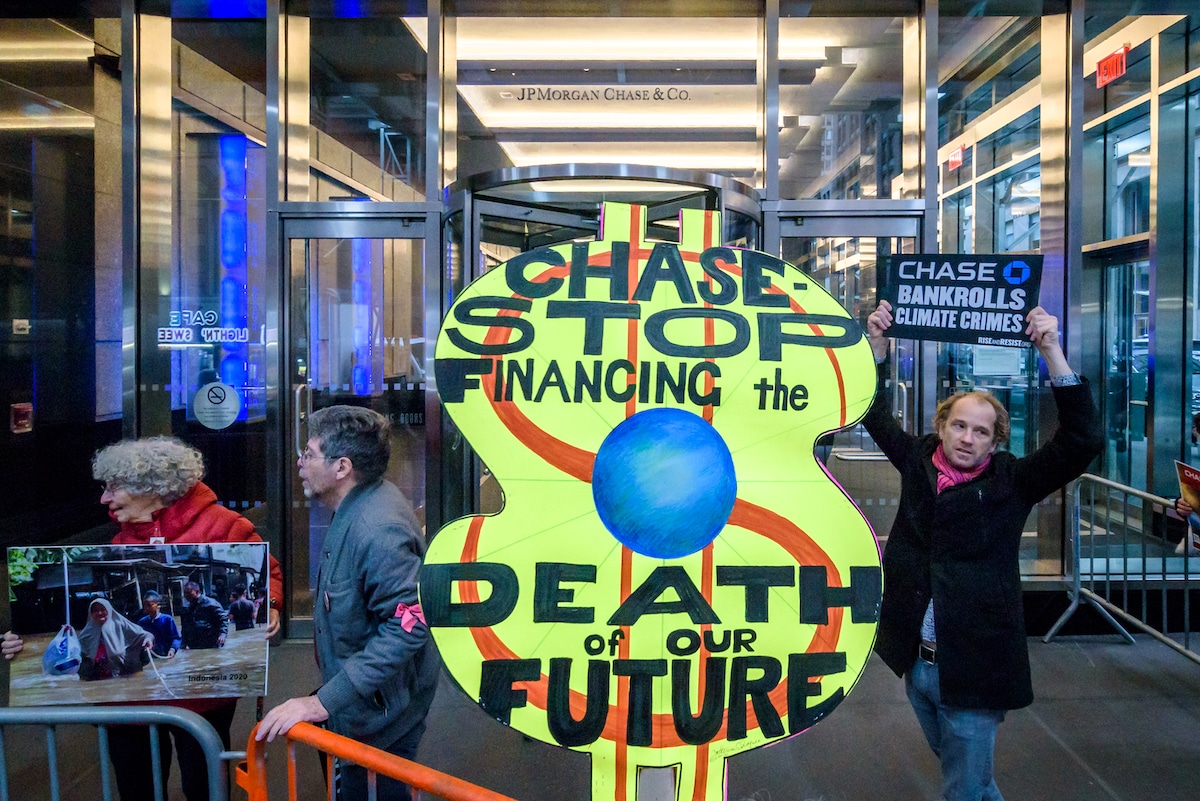

Protesters gathered outside the JPMorgan Chase headquarters in Manhattan, New York during Chase Bank’s Investor Day, demanding that the bank end its massive funding of the fossil fuel industry, on Feb. 25, 2020. Erik McGregor / LightRocket via Getty Images

Why you can trust us

Founded in 2005 as an Ohio-based environmental newspaper, EcoWatch is a digital platform dedicated to publishing quality, science-based content on environmental issues, causes, and solutions.

According to the new Banking on Climate Chaos Fossil Fuel Finance Report 2024, the largest banks in the world have given $6.9 trillion in fossil fuel funding to the industry since the 2016 Paris Agreement.

The goal of the Paris Agreement — signed by 196 countries — is to limit human-caused global heating to 1.5 degrees Celsius above pre-industrial levels by lowering carbon dioxide emissions. However, contrary to their pledges, private interests in many countries have kept funding the operations of fossil fuel companies, which have continued to expand, reported The Guardian.

The impacts of climate change most often affect vulnerable communities who are the least responsible for it.

“Climate change hits the frontlines first and worst. People living on the frontlines of climate chaos and the fossil fuel industry are predominantly Indigenous Peoples, Black and Brown communities, low-wage workers, women, fishers or smallholder farmers, often living in poverty,” Banking on Climate Chaos said.

For the 15th edition of the report, the researchers looked at the underwriting and lending of the biggest 60 banks globally to more than 4,200 oil, gas and coal firms that were causing environmental destruction in the Arctic and Amazon, The Guardian reported.

They discovered that, of the nearly $7 trillion given to the companies, almost half supported the expansion of fossil fuel development.

Banks in the United States were the biggest culprits, giving 30 percent of last year’s $705 billion total. JPMorgan Chase’s support of fossil fuels was $40.8 billion in 2023 — the largest financier. The second largest contributor was Japan’s Mizuho with $37.1 billion, while Bank of America was third.

Europe’s biggest donor was Barclays with $24.2 billion. A little more than a quarter of the financing last year came from European banks, the report said.

“Financiers and investors of fossil fuels continue to light the flame of the climate crisis. Paired with generations of colonialism, the fossil fuel industry and banking institutions’ investment in false solutions create unlivable conditions for all living relatives and humanity on Mother Earth,” said Tom BK Goldtooth, Indigenous Environmental Network’s executive director, as reported by The Guardian. “As Indigenous peoples, we remain on the frontlines of the climate catastrophe, and the fossil fuel industry targets our lands and territories as sacrifice zones to continue their extraction.”

Representatives of some of the banks — Bank of America, JPMorgan Chase, Barclays, Santander and Deutsche Bank — said their companies were supporting the transition of their clients in the energy sector toward more eco-friendly business models.

“Capitalism and its extraction-based economy will only perpetuate more harm and destruction against our Mother Earth and it must come to an end,” Goldtooth said.

Subscribe to get exclusive updates in our daily newsletter!

By signing up, you agree to the Terms of Use and Privacy Policy & to receive electronic communications from EcoWatch Media Group, which may include marketing promotions, advertisements and sponsored content.

Source

Disclaimer: No copyright infringement intended. All rights and credits reserved to respective owner(s).